What is the difference between a Medicare Supplement and Medicare Advantage health insurance plan?

How to find the right health insurance for you

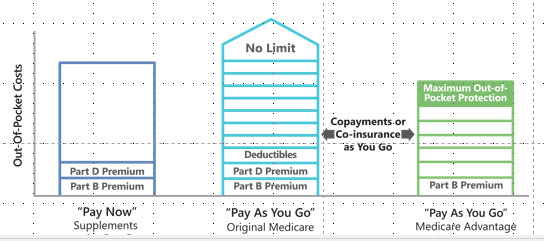

As soon as you start researching your Medicare coverage options, you quickly discover that Original Medicare, or Medicare Part A and Medicare Part B, isn’t enough. While it does cover 80 percent of your medical costs, it leaves you completely exposed for that other 20 percent. And there is no cap on the actual amount you may have to pay. Given how expensive medical care is, that 20 percent could easily take a big chunk out of your savings and retirement. And that does not include prescription drugs at all!

So, if you are like others researching your Medicare options, your next step is to look into how to cover that 20 percent — as well as the cost of prescription drugs. To do this, you have two options.

- Purchase a Medicare Supplement plan AND a Part D Prescription Drug Plan

- Enroll in a Medicare Advantage plan

While both of these options help cover the 20 percent of medical costs that Original Medicare does not pay, they are very different when it comes to how you pay. You will also learn that the overall healthcare experience you can expect from the options are very different as well.

"Pay Now” vs. “Pay As You Go.”

- Medicare Supplements work on a “pay now” basis. You pay for your care up front with fairly pricey, monthly premiums. In order to have coverage for your prescription medications, you will need to buy a separate Part D prescription drug plan. That Part D plan means you’ll have another monthly premium. It’s also worth noting that Medicare supplements do not offer dental or vision coverage.

- Medicare Advantage plans on the other hand usually don’t require any monthly premium. Instead, you “pay as you go” in small copayments (about $5-$10) for medical care when you need it. Most Medicare Advantage plans also have prescription drug coverage included, along with dental and vision coverage, with no added monthly premium.

"The Lone Wolf” vs. “The Pack.”

- With a Medicare supplement plan, you or a loved one has to manage all aspects of your care. These plans do not deliver care through a network of doctors, so it’s up to you to keep track of your care — any tests you’ve had run, medications you’re taking or specialists you’ve recently seen — and communicate between providers. So while you can see whomever you want to see whenever you think it’s necessary, you’ll be a lone wolf navigating the healthcare system.

- Medicare Advantage plans take more of the “pack” approach. You will receive services through a close network of doctors who were selected by your plan. While you generally have to stay in that network for services and supplies (unless it’s an emergency situation or you’re traveling outside of the network), your personal primary care physician (PCP) will serve as your care coordinator. Your PCP will work closely with your specialists and your health plan to ensure you’re well taken care of.

With either option, your savings and retirement won’t be exposed. It’s just up to you to decide which one fits better with your lifestyle and budget.

Essence Healthcare