Date: 02-May-2018

Category:

Medicare

While the word “MOOP” may not sound like a serious term, in the world of Medicare, it's actually a big deal. It can even protect your savings and retirement should a serious illness or injury occur.

Original Medicare, or Part A and Part B, covers 80 percent of your medical costs. This leaves 20 percent up to you, with no cap on that amount. Should something serious happen with your health, that 20 percent will add up quickly, leaving your finances at risk.

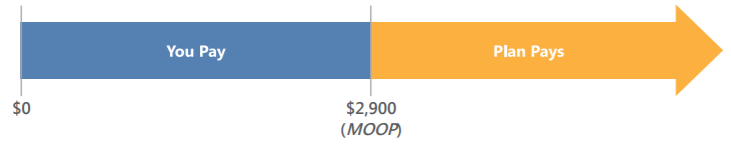

Fortunately, there are other ways to protect yourself, and that’s where the MOOP comes in. By signing up for a Medicare Advantage (MA) plan, you are protected from overwhelming medical expenses through maximum out-of-pocket (MOOP) protection. You will know the maximum costs you might have to cover. While each MA plan can set its own MOOP limit, the government does set the range. Averages will vary in each state, but in Missouri, for example, the average MOOP is between $2,300 and $6,700. For our example, let’s say your MOOP is $2,900. That means that if a serious health event occurs, the most you will ever have to pay for your medical expenses in a given year out of your own pocket is $2,900. These out-of-pocket costs include copays and co-insurance. Your MA plan covers the rest.

You’ll also receive coverage for medical expenses along the way, but the MOOP is always there — just in case you need it.

So how do you find out how much of your MOOP has been met for the calendar year? It’s easy. Just check your most recent Explanation of Benefits (EOB). The EOB is a statement sent by your health insurance plan that summarizes your medical claims and costs. The EOB will contain information on what your MOOP is and how much of it you’ve already met for the year.

Need more on MOOP? Head to the Medicare Learning Center and check out MOOP: Why You Want It and Where You Can Get It.

Maintaining a healthy body wei...

Uh oh! Have you missed your In...

Ready to take your health into...

The best way to protect yourse...

Medicare Advantage plans (also...